News

News Industry News

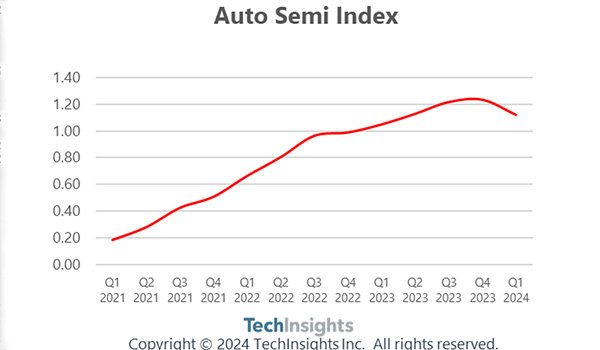

Industry NewsRecently, data released by renowned market research firm TechInsights showed that its Auto Semi Index has experienced a decline of 9.2% for the first time since the fourth quarter of 2020. This change is mainly attributed to the slowdown in sales of electric vehicles, as well as the destocking pressure from Tier 1 suppliers and original equIPMent manufacturer (OEM) customers under inventory adjustment strategies, which has had an impact on the revenue of automotive semiconductor suppliers in the first quarter of 2024.

Despite facing short-term market fluctuations, TechInsights points out that the automotive industry will usher in a brief transition period between hybrid and all electric vehicles in the future. During this period, OEM manufacturers will adjust their product portfolio to better meet consumer budget needs while promoting sustainable development in the electric vehicle market.

Despite the current market challenges, the long-term growth prospects of the automotive semiconductor market remain optimistic. With the popularization of electrified power systems, the pursuit of advanced safety, and the increasing preference of users for information entertainment and connectivity functions, the market demand for processors, power supplies, memory, linearity, and other semiconductors and related components will continue to remain strong. In addition, with the development of automotive electronic system architecture towards domain, regional, and centralized directions, the integration and complexity of automotive semiconductors are also constantly increasing.

Industry experts and analysts generally believe that the current automotive semiconductor market may be approaching or experiencing a cyclical bottom. According to TechInsights, the automotive semiconductor market is expected to resume growth in the second half of 2024. Based on in-depth analysis of automotive production trends, TechInsights predicts that demand for automotive semiconductors will increase by 13.2% throughout 2024. Looking ahead, by 2031, the demand for the automotive semiconductor market is expected to nearly double, providing huge development opportunities for enterprises and investors in the industry.

As the automotive semiconductor market experiences a brief downturn, major suppliers and OEM manufacturers are actively adjusting their strategies to cope with market changes and seize future development opportunities. At the same time, innovation and technological progress within the industry are constantly driving market growth and development.

Faust Technology focuses on the field of power devices, providing customers with power devices such as IGBT and IPM modules, as well as MCU and touch chips. It is an electronic component supplier and solution provider with core technology.