News

News Industry News

Industry NewsThe latest research report shows that the European printed circuit board (PCB) industry is experiencing a significant decline in global market share, highlighting the trend of global electronic manufacturing shifting to Asia, especially China. According to a study by the International Association for the Connection of Electronics Industries (IPC), compared to the glorious period of the 1990s, the current PCB output value of the European Union has significantly shrunk, accounting for only 2% of the global market, far lower than the previous 20-30% share.

This study provides an in-depth analysis of the changes in the global competitive landscape of the European PCB industry. The report points out that in the past 20 years, with the concentration of global manufacturing in Asia, especially in China, the number of PCB manufacturing factories in Europe has sharply decreased, now less than 180. At the same time, Europe's dependence on PCB imports from China is constantly increasing, with up to 65% of imported PCBs currently coming from China.

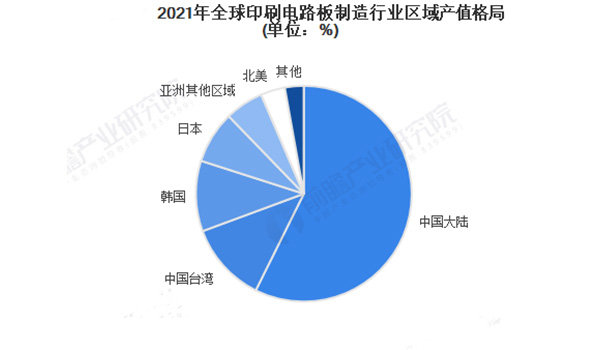

Source: Forward Industry Research Institute

The PCB industry, as the industry with the largest proportion of output value in the global electronic component sub industry, has always been closely watched for its development trend. Before 2000, the Americas, Europe, and Japan accounted for over 70% of the global PCB production value. However, with the increasingly prominent advantages of Asia, especially China in terms of labor, resources, policies and industrial agglomeration, the global electronics manufacturing capacity has begun to transfer to Asian regions such as Chinese Mainland, Taiwan, China and South Korea. Since 2006, Chinese Mainland has surpassed Japan to become the world's largest PCB producer.

According to Prismark's previous prediction, Asia will continue to dominate the development of the global PCB market in the future, while China's core position will become more stable. The PCB industry in Chinese Mainland is expected to have a compound annual growth rate of 4.30%, and the total output value will reach 54.605 billion US dollars by 2026. This prediction not only highlights China's dominant position in the global electronic supply chain, but also reflects the strong competitiveness of Chinese PCB manufacturers in terms of output and specialized, high value-added product production.

The decline of the European PCB industry is closely related to global industrial transfer and technological development. On the one hand, the production cost advantage in the Asian region has attracted a large amount of international investment, promoting the development of the local PCB industry; On the other hand, with the continuous updating and upgrading of electronic products, the technical requirements for PCBs are also increasing. Chinese PCB manufacturers have made significant progress in technological innovation and product research and development, further consolidating their position in the global market.

Faced with fierce competition in the global PCB market, European companies are also striving to find new development opportunities. Some European PCB manufacturers have begun to strengthen cooperation with Asian companies, enhancing their competitiveness through technological exchange and industrial cooperation. At the same time, European governments are actively formulating relevant policies to support the development of the local PCB industry and respond to the challenges of the global market.

Overall, the decline in the global market share of the European PCB industry is an undeniable fact. However, against the backdrop of the global electronic manufacturing industry continuously shifting to Asia, especially China, European companies are also striving to find new development opportunities. In the future, with the continuous progress of technology and changes in the market, the competitive landscape of the global PCB market will continue to evolve.

Faust Technology focuses on the field of power devices, providing customers with power devices such as IGBT and IPM modules, as well as MCU and touch chips. It is an electronic component supplier and solution provider with core technology.