News

News Industry News

Industry NewsRecently, STMicroelectronics released its Q2 2024 financial report, which showed that the company's net revenue for the quarter was $3.23 billion (approximately RMB 23.403 billion), a decrease of 25.3% compared to the same period last year. This number reflects the challenges faced by the company in the face of fierce market competition and uncertain economic environment.

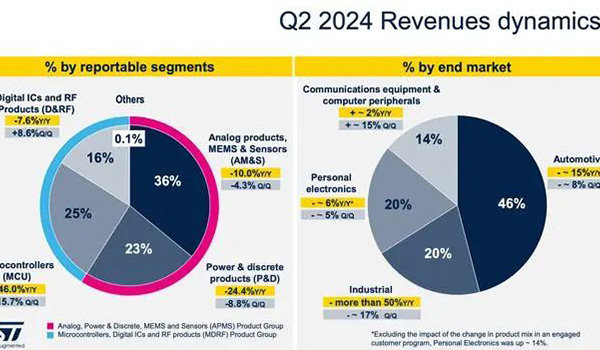

According to the financial report, the overall gross profit margin of the company was 40.1%, a decrease of 890 basis points compared to the same period last year, indicating the compression of profit margins due to rising production costs and weak market demand. Specifically, STMicroelectronics' revenue from analog, power and discrete devices, MEMS, and sensor product groups decreased by 16.2% year-on-year to $1.91 billion. In addition, the revenue of the microcontroller, digital IC, and RF product groups showed a more significant decline, with a year-on-year decrease of 35.5%, only about 1.32 billion US dollars.

Jean Marc Chery, President and CEO of STMicroelectronics, stated in the financial report that the performance for this quarter did not improve as expected, especially with no significant recovery in industrial customer orders and a downward trend in demand in the automotive sector. Nevertheless, the net revenue for the second quarter remained higher than the median guidance range previously predicted, partly due to sales growth in the personal electronics sector. However, the lower than expected performance of the automotive business has had a certain negative impact on overall revenue.

In industry analysis, the current global semiconductor market faces many challenges, including supply chain uncertainty, geopolitical tensions, and fluctuations in consumer demand. These factors work together to affect the performance of many semiconductor companies, including STMicroelectronics.

It is worth noting that STMicroelectronics has also made new progress in focusing on the production of silicon carbide power semiconductors. According to a report on June 28th, the company plans to upgrade its production process for silicon carbide power semiconductors from 6 inches to 8 inches starting from the third quarter of next year. This measure aims to improve production efficiency and output in order to supply silicon carbide power semiconductors to the market at a more competitive price. The application of silicon carbide materials in fields such as electric vehicles and renewable energy is becoming increasingly widespread, so this transformation is widely regarded by the industry as an important step for STMicroelectronics to reshape its competitiveness in the future market.

Overall, STMicroelectronics' Q2 2024 financial report reflects the complex situation of the current semiconductor industry. Although facing many challenges, the company's efforts in technological upgrades and product line expansion may bring new opportunities for it in future market competition. With the gradual recovery of the global economy, the business demand of enterprises is expected to rebound. How STMicroelectronics adjusts its strategy and enhances its product competitiveness in this process will be a focus worth paying attention to in the future.

Fushite Technology focuses on the field of power devices, providing customers with power devices such as IGBT and IPM modules, as well as MCU and touch chips. It is an electronic component supplier and solution provider with core technology.