News

News Industry News

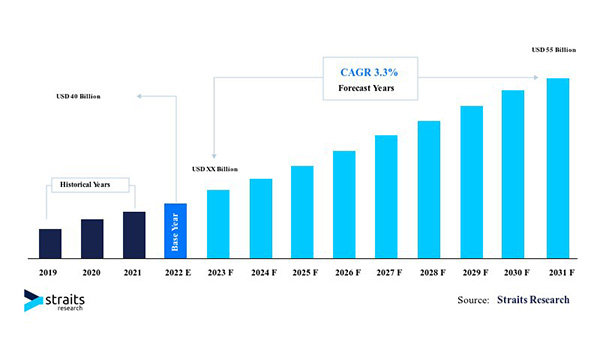

Industry NewsAccording to a report released by Straits Research, the global power semiconductor industry was valued at $40 billion in 2020. It is expected that the value could reach $55 billion by 2030, with a compound annual growth rate (CAGR) of 3.3% during the forecast period from 2022 to 2030.

The study "Power Semiconductor Market Trends, Growth to 2022-2030" examines different types of power semiconductors (including discrete devices, power modules, and power integrated circuits) and different types of materials (silicon, germanium, silicon carbide, and gallium nitride).

Power semiconductor is a special electronic component used to manage high current and/or high voltage. In many electronic systems, they play an important role in managing and guiding the flow of electrical energy. Power semiconductors are highly suitable for applications involving high power levels, as they can withstand higher voltages and currents than ordinary semiconductor devices.

The wide bandgap semiconductor materials SIC and GaN have attracted widespread attention in the field of power electronics due to their unique characteristics. SiC and GaN are both important components in the development of power electronics, as they have higher efficiency, higher power density, and higher operating frequency compared to traditional silicon-based devices. The unique characteristics of these entities make them highly suitable for various applications across multiple industries.

The main driving force for the expected market expansion (Figure 1) is the strengthening of research and development efforts aimed at improving material properties, especially wide bandgap materials.

Driving factors and risks

According to research, market growth is driven by the increasing global demand for consumer electronics products. Nowadays, various consumer products rely on semiconductors, including communication devices (such as smartphones, tablets, smartwatches, etc.), computers (personal and business computers), entertainment systems, and household appliances.

The smartphone industry is the main consumer of semiconductors in this market, and competition has been fierce in recent years. In addition, the surge in mobile phone usage is expected to drive the global market forward. For example, Ericsson predicts a significant increase in global smartphone data traffic, from 32 EB in 2019 to 221 EB per month in 2026.

According to the Indian Brand Asset Foundation, the Indian home appliance and consumer electronics market is expected to grow at a compound annual growth rate of 9%, reaching 3.15 trillion Indian rupees (approximately 48.37 billion US dollars) by 2022. This expected growth will further promote market expansion in the foreseeable future.

With the increasing demand for consumer electronics and wireless communication, other factors such as the growing demand for energy-efficient battery powered portable devices are expected to stimulate demand and have a positive impact on market expansion.

Although lithium-ion remains the primary technology for powering consumer devices, some limitations pose challenges to these modern batteries. Extending battery life has become a common trend in the industry, driving global efforts to develop more energy-efficient battery solutions. The market growth in this field is driven by manufacturers increasing the battery capacity of their products, thereby meeting consumers' demand for faster charging times. The growing demand for energy-saving battery technology will drive market expansion during the forecast period.

The main risks that may hinder market expansion include global silicon wafer shortages and challenges in driving SiC power devices. Research indicates that the main goal of SiC based devices is to replace IGBT. However, the driving prerequisites for these two devices are very different. Transistors typically exhibit driving requirements and require the use of symmetrical power rails, such as ³ 5 V. On the other hand, SiC devices require asymmetric power rails (ranging from -1 V to -20 V) because low negative voltages are needed to ensure complete shutdown. The use of these devices in portable devices may be hindered by the need for additional DC/DC drivers or specific batteries with three connectors (+, 0 V, and -). Therefore, these obstacles hinder the expansion of the market.

The increasing use of power semiconductors in various industries such as IT and consumer electronics, automotive, power distribution, and railway transportation is expected to be driven by the continued growth of alternative energy sources. The adoption in the automotive industry is mainly due to the growing demand from consumers for enhanced power management and new safety features. Some electric vehicle applications have integrated SiC technology for functions such as battery chargers, auxiliary DC/DC converters, and solid-state circuit breakers. A more efficient transmission system based on SiC power devices enables engineers to meet high voltage and power requirements in an economically efficient manner.

Market by Region

The global power semiconductor market is divided into five main regions: Europe, Latin America, Asia Pacific, North America, and the Middle East and Africa.

The Asia Pacific region is expected to continue to dominate the market with a compound annual growth rate of 3.6% throughout the forecast period. Due to its dominant position in the global semiconductor industry and government legal support, power semiconductor sales are likely to be the highest in the Asia Pacific region. Approximately 65% of the global discrete semiconductor market is held by only four countries: China, Japan, Taiwan, and South Korea. The presence of other countries such as Vietnam, Thailand, Malaysia, and Singapore greatly enhances the dominant position of the market in the region.

The Indian Electronics and Semiconductors Association states that India is an ideal location for multinational research and development centers. Therefore, the semiconductor industry is expected to benefit from the government's ongoing "Make in India" initiative. In addition, the region is a major player in the electronics manufacturing industry, producing millions of products annually for both domestic and international markets. The increase in production of electronic products and components has had a significant impact on the market share of the researched industry.

North America is the second largest region in the semiconductor industry. It is expected that by 2030, its market size will reach approximately 8.5 billion US dollars, with a compound annual growth rate of 2.6%. North America is known as a pioneer in adopting new technologies in manufacturing, design, and research, and is at the forefront of semiconductor innovation. The growth of the power semiconductor market in this region is closely related to the progress of key end-user industries such as automotive, IT, telecommunications, military, aerospace, and consumer electronics.

In January 2021, the Semiconductor Industry Association (SIA) reported direct sales of $40 billion, a significant increase of 13.2% from $35.3 billion in January 2020. SIA represents 98% of the revenue of the US semiconductor industry and a significant portion of non US chip companies, playing a pivotal role in the industry. In addition, the policy shift affecting semiconductor supply in the United States is expected to promote domestic manufacturing and equIPMent investment.

Europe is the third largest region in the world, with some of the world's most critical technology centers, playing an important role in promoting and embracing contemporary technology. The growth of the market is driven by the continuous expansion of modern technology integration and the increasing use of semiconductors in different industries. Local governments are increasingly involved in promoting research programs, which has spurred the development of numerous industries focused on semiconductors, and the presence of strong technological infrastructure further promotes this trend. The German government has promised to increase the number of research enterprises to 20000 and the number of innovative enterprises to 140000 by 2020. According to World Semiconductor Trade Statistics and SIA reports, semiconductor sales in Europe increased by 6.4% in 2019. These advances have promoted the expansion of the industry.

Fushite Technology focuses on the field of power devices, providing customers with power devices such as IGBT and IPM modules, as well as MCU and touch chips. It is an electronic component supplier and solution provider with core technology.